- Tricare Copay List

- Tricare Copay 2020

- Tricare Copay For Prescriptions

- Tricare Copayments

- Tricare Copay Urgent Care

- Tricare Copays For Retirees

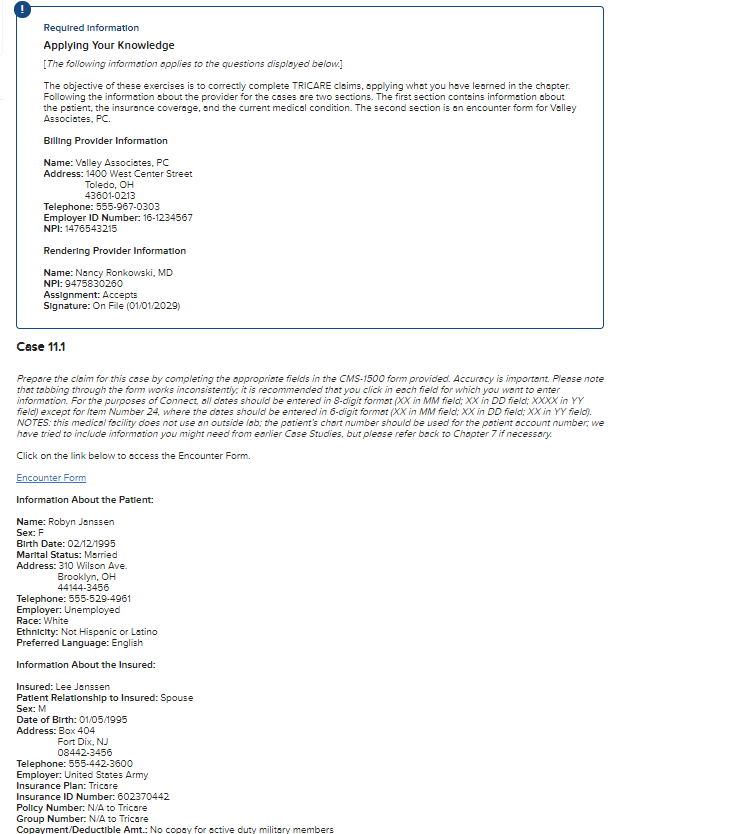

Covered Services

Copayments and cost-shares are subject to change at the beginning of each calendar year. Copayments are per occurrence or per visit. Cost-shares are a percentage of the contracted rate for network providers and the maximum TRICARE allowable for non-network providers on certain types of services.

Learn more about what we cover -including health, dental, and pharmacy.

On Jan. 1, some copayments for your prescription drugs will increase. If you get your prescriptions through the TRICARE Pharmacy Home Delivery or at a retail network pharmacy, you’ll pay anywhere from $2 to $7 more starting Jan. 1. Congress made this change in the National Defense Authorization Act for Fiscal YearOctober 1 - September 30 2018.

If you wish to reinstate your TRICARE Select Group A coverage, you must now call us before June 30 at (800) 444-5445. Continued Health Care Benefit Program (CHCBP) CHCBP is a premium-based plan that offers temporary transitional health coverage for 18 to 36 months after TRICARE eligibility ends. It acts as a bridge between military. This page contains the link to the Benefits A-Z area which explains what is covered, excluded or has limitations.as well as important cost information.

Tricare Copay List

There’s still no cost to fill your prescriptions at military pharmacies. And these cost changes don’t apply to active duty service members (ADSMs). If you’re an ADSM, you still pay nothing for your covered drugs at military and network pharmacies.

“Military pharmacies remain to be your lowest cost option,” said U.S. Air Force Lt. Col. Melissa Pammer with the Pharmacy Operations Division at the Defense Health Agency. “Your next lowest cost is if you use the TRICARE Pharmacy Home Delivery.”

TRICARE Prescription Drug Categories

Your prescription copayments vary based on pharmacy type. Also, they vary based on the drug category. TRICARE groups prescription drugs into one of four categories. This grouping is based on the medical and cost effectiveness of a drug compared to other drugs of the same type.

As outlined in the TRICARE Pharmacy Program Handbook, the drug categories include:

- Generic formulary drugs: These drugs are widely available. You have the lowest out-of-pocket costs for these drugs.

- Brand-name formulary drugs: These drugs are generally available to you. Plus, they offer you the second lowest copaymentA fixed dollar amount you may pay for a covered health care service or drug..

- Non-formulary drugsA drug in a therapeutic class that isn’t as clinically or cost-effective as other drugs in the same class. You pay a higher cost share for these drugs.: These drugs may have limited availability. You have higher copayments for these drugs. Also, there’s generally an alternative formulary drug that you can get. It’s often more cost effective, and equally or more clinically effective.

- Non-covered drugs: TRICARE doesn’t cover these drugs. If you choose to purchase a non-covered drug, you’ll pay 100% of the drug’s cost. These drugs are either not clinically effective, or as cost effective as other drugs offered. They may also pose a significant safety risk that may outweigh any potential clinical benefit.

To learn more, you can download the TRICARE Pharmacy Program Handbook from the Publications page.

Pharmacy Copayment Increases

TRICARE Pharmacy Home Delivery

If you use home delivery, your copayments for up to a 90-day supply of generic formulary drugs will increase from $7 to $10. For brand-name formulary drugs, your copayments will increase from $24 to $29. Your copayments for non-formulary drugs when you don’t have a medical necessity will increase from $53 to $60.

TRICARE retail network pharmacies

At a retail network pharmacy, your copayments for up to a 30-day supply of generic formulary drugs will increase from $11 to $13. For brand-name formulary drugs, the increase is from $28 to $33. Non-formulary drugs will increase from $53 to $60.

Non-network pharmacies

At a non-network pharmacy, you must pay the full price of the drug. After meeting your annual deductible, you may submit a claim for partial reimbursement. Non-network pharmacy costs remain the same if you use TRICARE Prime. With TRICARE Prime, you’ll pay a 50% cost-shareA percentage of the total cost of a covered health care service that you pay. after meeting your point-of-service deductible for covered drugs.

For all other health plans, non-network pharmacy costs are as follows:

- Generic formulary drugs and brand-name formulary drugs will cost $33 (up from $28) or 20% of the total cost, whichever is more, after you meet your annual deductible.

- Non-formulary drugs will cost $60 (up from $53) or 20% of the total cost, whichever is more, after you meet your annual deductible.

Copayments for survivors of ADSMs are the same as the 2017 rates. The copayments remain the same for medically retired service members and their family members, too.

For the latest TRICARE pharmacy costs, you should visit TRICARE Costs. To learn more about your pharmacy benefit, visit Pharmacy on the TRICARE website.

Tricare Copay 2020

Last Updated 2/17/2021

Costs

Tricare Copay For Prescriptions

Find your TRICARE costs, including copayments,enrollment fees, and payment options.

Tricare Copayments

Here are some definitions to help you better understand your costs with TRICARE.

| Term | Definition | Plans where you will find it | Additional Information |

|---|---|---|---|

| Allowable chargeThe maximum amount TRICARE pays for each procedure or service. This is tied by law to Medicare's allowable charges. | The maximum amount TRICARE will pay a doctor or other provider for a procedure, service, or equipment. Non-participating providers can charge you up to 15% more than the allowable charge that TRICARE will pay. If you use a non-participating provider, you will have to pay all of that additional charge up to 15%. | All TRICARE plans | TRICARE sets CHAMPUS Maximum Allowable Rate (CMAC) for most services. Many rates vary based on location, since health care costs more in some places and less in others. In some cases, federal law requires a set rate. You can find more info at www.health.mil/rates. |

| Annual deductible | The amount you must pay before cost-sharing begins. | TRICARE Select TRICARE Select Overseas TRICARE Reserve Select TRICARE Retired Reserve TRICARE Young Adult-Select option TRICARE For Life (for services not covered by both Medicare and TRICARE) If you have a TRICARE Prime plan, you have to meet your annual deductible when using the point-of-service option. | When you meet your individual deductible, TRICARE cost-sharing will begin. |

| Catastrophic cap | The most you pay out of pocket annually for TRICARE covered services. | All TRICARE plans | Fees for covered services, including yearly (calendar year) enrollment fees, deductibles, copayments, pharmacy copayments, and other cost-shares based on TRICARE-allowable charges, apply toward your catastrophic cap. Point-of-service fees for TRICARE Prime don't apply toward your catastrophic cap. For premium-based plans, your monthly premiums don’t apply toward your catastrophic cap. |

| copaymentA fixed dollar amount you may pay for a covered health care service or drug. | The fixed dollar amount you pay for a covered health care service or drug. | TRICARE Prime and TRICARE Prime Remote (Doesn't apply to active duty service members) TRICARE Select for services received from network providers. | A copayment for an appointment also covers your costs for tests and other ancillary services you get as part of that appointment. So if your doctor runs blood work as part of your visit, or you have an EKG or other test covered by TRICARE, you normally won't have a separate copayment for those tests. |

| cost-shareA percentage of the total cost of a covered health care service that you pay. | The percentage of the total cost of a covered health care service that you pay. | All TRICARE Plans (Doesn't apply to active duty service members) | If you see several doctors as part of an appointment, or have additional tests, you may have more than one cost-share. For instance, if you have a surgery, you may have separate cost-shares for the facility, the surgeon, and the anesthesiologist. |

| Negotiated rate | The contractors who manage care in the civilian network try to save you and the government money by making agreements with providers to accept less than the allowable charge for your care. | All TRICARE Plans (Doesn't apply to active duty service members) | Since some plans have cost-shares that are a percentage of the charge, a lower rate helps keep your costs down. That’s why it's usually less expensive for you to use a network provider for your care. |

| Point-of-service fees | The fees you pay when you see a TRICARE-authorized providerAn authorized provider is any individual, institution/organization, or supplier that is licensed by a state, accredited by national organization, or meets other standards of the medical community, and is certified to provide benefits under TRICARE. There are two types of TRICARE-authorized providers: Network and Non-Network. DS other than your primary care manager for any non-emergency services without a referral. The costs are higher when you don’t follow referral requirements or use non-network providers without authorization from the TRICARE regional contractor. | TRICARE Prime (Doesn't apply to active duty service members) | You pay an annual deductible before TRICARE cost-sharing begins. The deductibles are $300 per individual/$600 per family. For services beyond this deductible, you pay 50% of the TRICARE-allowable charge. These costs don't apply to your catastrophic cap. |

| Travel expensesAmounts you pay when traveling to and from your appointment. This includes costs for gas, meals, tolls, parking, lodging, local transportation, and tickets for public transportation. | The amount you pay when traveling to and from your appointment. This includes costs for gas, meals, tolls, parking, lodging, local transportation, and tickets for public transportation. | TRICARE Prime TRICARE Prime Remote TRICARE For Life Prime Travel Benefit | In some instances, TRICARE may reimburse your travel expenses for care. To receive reimbursement for travel expenses for specialty care:

If all three apply to you, you may qualify for the Prime Travel Benefit. |

| TRICARE diagnostic-related group (DRG) | A payment system that determines the allowable amount. | TRICARE Select | >>Learn more |

Tricare Copay Urgent Care

Last Updated 3/23/2021

Tricare Copays For Retirees

Find a Doctor